As a further check I compared some of the individual

terms in the matrix to be inverted. Those I checked

differed only in the fourth or fifth decimal place.

As we know from the Mars lander, units and rounding

errors can make a great deal of difference.

5. Learning curve and

autocorrelation.

The data used to create the question are hidden in the

following region:

b. Compute the efficient estimator. Since I have the

original data I show the result using them.

The coefficient covariance matrix is estimated to be:

Notice that the variances are smaller than when the

data is not corrected for heteroscedasticity.

Computing the coefficient estimates using the sums of

squares and cross products as they were given to you

These estimates differ numerically from those using

the original data. This is do to rounding errors.

To convince you I have redone the same matrix calculations

using the symbolic sums of squares and cross products.

b. Compute an estimate

of r

the serial correlation coefficient.

c. 1971 production is expected to be 3800. What is

the point prediction for unit costs?

We have to restimate the model correcting for autocorrelation,

a. Compute the Durbin-Watson statistic and test for

autocorrelation at the 5% level

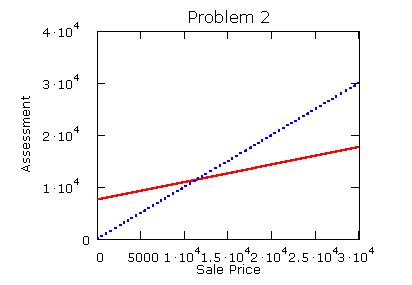

The blue line has slope 1. The red line is equation

1, with slope of .34. Below a sale price of about

$11,000 the ratio of assessment to sale price is greater

than 1, but it decreases for as home value in the market

grows. You can make a similar argument for equation

4.

3. Australian wheat

growing

Set the sample size and a time index.

Create and intercept and a trend.

In MathCAD the data is hidden inside the area represented

by the horizontal line.

Create the design matrix.

Estimate the model parameters.

Create indices to split the sample, then create new

data sets for each half and estimate the coefficients.

Temple University

Department of Economics

Final Exam Key

Econ 615

Fall 2001

1.a. Show that the covariance of the RLS and OLS estimators

is equal to the variance of the RLS estimator.

Factor out the b

hat - b term

and make use of the fact that bhat - b

is equal to (x'x)-1x'u.

We have the definition of covariance Cov(bhat, b*

) = E(b

hat-b)(b*

-Eb*)'.

which is the desired result.

b. When testing the hypothesis

that bhat

- b

*=0 we would ordinarily need Var(bhat-b*)

= Var(bhat)+Var(

b

*)-2Cov(bhat,b

*). By the inequality proved in part a we only need

Var(bhat)-Var(

b

*). This makes construction of the Wald statistic much

simpler.

2. a

. (1) For each $1 increase in sale price the assessment

will be only $.34 higher. There is evidence of inequity.

This model and its interpretation is similar in spirit

to the marginal propensity to consume and average propensity

to consume debate in Keynesian economics. Specifically,

you ought to have discussed at least tangentially the

picture following part 2.c.

(2) For each $1 increase in sale price the ratio

of assessment to sale price will fall 4.57. We would

expect the coefficient to be zero if there was no inequity.

(3) The elasticity

of assessment with respect to sale price is .67. That

is a 1% increase in sale price will result in only

a .67% increase in assessment. So assessment rises

less than proportionately to an increase in sale price.

There is evidence of inequity

(4) For each $1increase in assessment, the sale

price will rise by $.77. Did you notice that the R2

is the same as equation 1. Do you know why? Also,

this model is equivalent to specifying model 1, but

instead of minimizing the errors in the A direction(or

vertical dimension) they errors are minimized in the

sale price direction (or horizontal dimension).

(5) for each $1 rise in assessment the ratio

of assessment to sale price will fall by .0000004.

So assessment as a fraction of home value is smaller

for more highly assessed homes. Notice that there

is no overall significance here. Why?

b.

The debate focuses on explaining variation in sales

price as a function of assessment, or assessment as

a proportion of sale price. There is also a question

of chronology and causality.

c.

(2) and (5) permit a non-linear relationship that

directly addresses the issue of assessment as a proportion

of sale price, whereas (1) and (4) do not.

The observed F falls in the rejection region.

The sums of squares and cross products given in the

question were created here.

Estimate the standard deviation of the error term for

each half the sample. This information was given in

the question.

a. Test the hypothesis of homoscedasticity at the 5%

level.

The critical F with <10,10> degrees of freedom

is